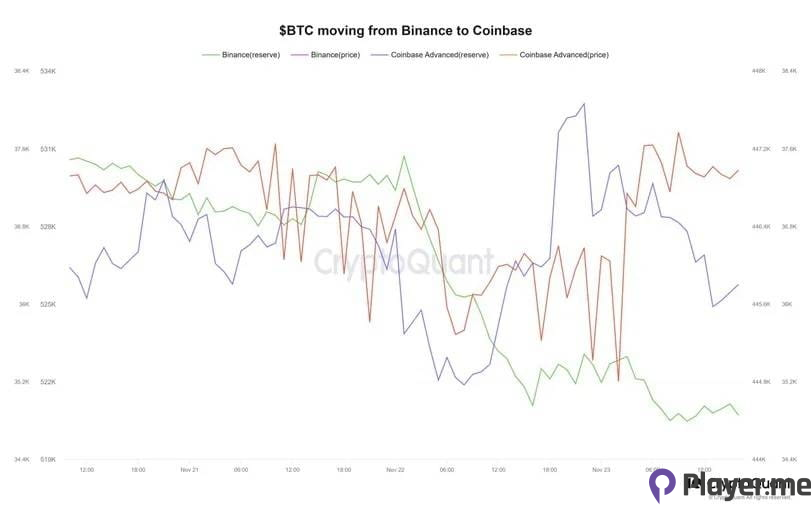

Recent data from CryptoQuant has illuminated a notable shift in the landscape of cryptocurrency exchanges, with a significant decline in Binance’s Bitcoin reserves and a simultaneous surge on the rival platform, Coinbase. The dynamics of this transition, fueled by small-scale retail investors, are reshaping the industry and prompting speculation about its implications.

Also Read: Coinbase vs. Robinhood: Which Should You Choose?

Coinbase’s Ascendance and the Decline in Binance’s Bitcoin Reserves

Coinbase, the U.S.-based crypto exchange, has seen a twofold increase in its Bitcoin (BTC) reserves on Coinbase Pro, receiving a substantial influx of 12,000 BTCs. In stark contrast, there’s been a direct decline in Binance’s Bitcoin reserves, with its figures dwindling to 5,000 BTC. Bradley Park, an analyst at CryptoQuant, attributes this shift to small-scale retail investors.

Greta Yuan, the research head at VDX, underscores the market’s uncertainty amid the recent legal challenges Binance faced. She anticipates a surge in seekers of alternative safe havens in the short term. Despite Coinbase’s gains, CryptoQuant notes that Binance still dominates spot BTC trades, exceeding Coinbase’s volume by six times.

Legal Challenges and Retail Outflows

The recent revelations surrounding a decline in Binance’s Bitcoin reserves have become a focal point in the industry’s discourse. This decline is intertwined with a hefty $4.3 billion fine that Binance faced, triggering widespread speculation about its effects on Coinbase’s retail outflows.

However, CryptoQuant suggests the primary driver is the ongoing discourse surrounding the spot BTC Exchange-Traded Fund (ETF). Coinbase has been a preferred custodian for Wall Street giants planning ETF launches despite potential hurdles causing delays, as indicated by BitGo’s CEO.

This legal turmoil has cast a shadow on Binance, with repercussions echoing throughout the crypto industry. The $4.3 billion settlement on November 21 involved Changpeng Zhao (CZ) admitting guilt in money laundering charges and stepping down as CEO. The resolution temporarily eases the multi-year investigation between the exchange and U.S. authorities.

Quick Link: Binance’s proof-of-reserves conducted by CryptoQuant confirms “All is well”

Binance’s Leadership Shift and Industry Dynamics

CZ’s acknowledgement of wrongdoing, assumption of total responsibility, and the appointment of Richard Teng as the new CEO signal a significant chapter in Binance’s history. CZ faces an individual fine of $50 million and a potential jail sentence of up to 18 months, with the sentencing scheduled for February 23, 2024.

Despite these setbacks, Binance remains the world’s largest cryptocurrency exchange, holding over $65 billion in customer assets. The large outflow of funds, comparable to the SEC accusations in June, highlights the substantial repercussions Binance faces.

The situation prompts a closer examination of the intricacies of the crypto industry and the factors influencing the movement of funds. The revelations about the decline in Binance’s Bitcoin reserves highlight the challenges major players face in the market and the interconnected nature of various crypto exchanges.

Also Read: Is Binance’s Founder Changpeng Zhao Big Enough to Survive a $4.3B Fine and Ousting?

Coinbase’s Role in Bitcoin Spot ETFs

The quest for a BTC spot ETF has garnered attention from major asset management firms like BlackRock, Valkyrie, Grayscale, and Fidelity. Coinbase emerges as a unifying force, serving as a critical custodian for these firms’ spot BTC ETFs. The outflows from Coinbase are deemed natural, especially in the context of the decline in Binance’s Bitcoin reserves. This is significant given Coinbase’s anticipated pivotal role in facilitating BTC spot ETFs for trillion-dollar asset management firms.

Despite the SEC’s historical reluctance to approve such ETFs, recent developments suggest an increased likelihood of approval for a BTC spot ETF in the coming weeks. Bloomberg’s ETF analyst, James Seyffart, places the approval percentage at a significant 90%, projecting January 2024 as the anticipated time frame for a regulatory green light.

Coinbase, listed on the Nasdaq trading floor, is the preferred trading firm for most institutional players in the U.S. and worldwide. Brian Armstrong, Coinbase’s CEO, expressed optimism amid these seismic industry events, believing that the cryptocurrency sector will witness a fresh start following the Binance debacle. The ripple effects of these high-profile developments are expected to resonate throughout the crypto landscape, influencing its future trajectory.

Related: CME Surpasses Binance, Secures Top Position in Bitcoin Futures Open Interest

Industry Transformations and Regulation

The recent developments surrounding Binance have added a layer of complexity to an already evolving regulatory landscape. CZ’s admission of guilt and the $4.3 billion settlement signal a turning point in the relationship between Binance and U.S. authorities. The legal uncertainties surrounding one of the industry’s major players have implications far beyond the confines of Binance.

This shift has led to speculation about the potential motivations behind retail outflows from Coinbase. Some investors in the crypto community connect the $4.3 billion fine imposed on Binance to Coinbase’s significant retail outflows. However, CryptoQuant reveals a more nuanced picture, pointing to the ongoing discourse surrounding the spot BTC ETF as a primary driving force.

Also Read: Bitcoin Price Hike and BIP 324 Integration: Making It Harder for Governments to Censor Transactions

Anticipating the Future: Spot BTC ETF Approval

The quest for a BTC spot ETF has been a focal point for the cryptocurrency industry, with numerous asset management firms submitting applications and amendments to the U.S. Securities and Exchange Commission (SEC). Despite the SEC’s historical concerns about market manipulation and risks to investors, recent developments suggest an increased likelihood of approval.

Bloomberg’s ETF analyst, James Seyffart, paints an optimistic picture, stating that the approval percentage has significantly increased to 90%. He anticipates January 2024 as the expected timeframe for the regulatory green light. This potential approval signifies a monumental step for the cryptocurrency industry, opening new avenues for investment and institutional participation.

Also Read: Kraken Sued by SEC in Latest Clampdown on Crypto Exchanges

Navigating Uncertainties in the Crypto Landscape

The cryptocurrency industry is experiencing a paradigm shift, with Coinbase’s ascent and a decline in Binance’s Bitcoin reserves while it grapples with legal challenges. The outflows from Coinbase are intertwined with the broader industry dynamics, causing industry players to navigate uncertainties and anticipate transformations.

As we move forward, the crypto industry braces for potential regulatory shifts, institutional participation, and the realisation of a Bitcoin spot ETF. Coinbase’s role as a preferred trading firm for institutional players positions it at the forefront of these changes. Meanwhile, the industry continues to develop, with changes in legal, regulatory, and market forces.

Author Profile

Latest entries

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style!

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style! NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S.

NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S. GAMING2024.03.17PS Plus: 7 New Games for March and Beyond

GAMING2024.03.17PS Plus: 7 New Games for March and Beyond GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It

GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It