Tether Holdings Ltd.’s Chief Technology Officer Paolo Ardoino is hardly crypto’s most well-known public figure. That may change when he takes over the reins of one of the sector’s most dominant businesses along with the $84 billion stablecoin it issues.

Also Read: How PayPal’s PYUSD Could Change the Crypto Landscape

Paolo Ardoino: A Quiet Figure in a Pivotal Role

The Italian software engineer — who will lead the company as its new chief executive from December — isn’t known for appearing on magazine covers, posing for selfies with G7 dignitaries, or rubbing shoulders with celebrities like some of his peers. While the rest of Tether’s leadership has mainly stayed absent from public view, Ardoino emerged as the company’s unofficial frontman, communicating primarily via social media posts, media interviews, and the occasional industry conference.

When asked in an interview earlier this year why he became the figurehead for the world’s most-traded cryptocurrency, Ardoino said, “Our CEO and our CFO are among the smartest people you could ever meet. But also, they are not public people.” “We pulled from sticks, and I had the shortest one.”

Also Read: Sam Bankman-Fried, the Fallen Wunderkind of Cryptocurrency

The Rise of Tether

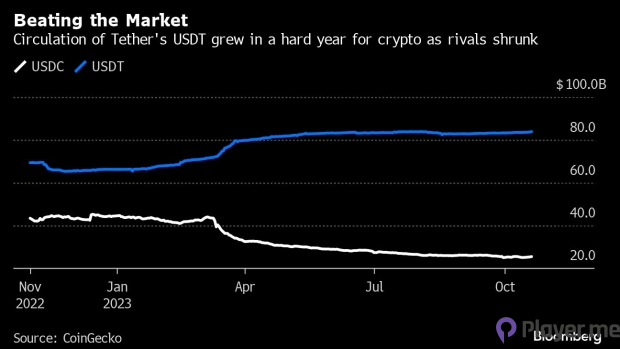

Tether’s USDT — a digital token that aims to maintain a one-to-one value with the U.S. dollar — has grown in circulation over the past year, even as other crypto companies struggled. Now accounting for nearly 70% of the stablecoin market, it’s become integral to how investors trade and store their digital asset wealth.

At the same time, for a company so systemically important, little is known about how it operates. Tether has also continued to contend with a perceived lack of transparency over the makeup of the reserves backing its stablecoin.

Also Read: The LUNA Death Spiral: What Happened to the Stablecoin in 2023?

Challenges and Transparency Concerns

Tether paid over $40 million to settle allegations by a U.S. watchdog in 2021 that it lied about its collateral pile, skewing public opinion against its reliability. Tether has also been criticised for its reliance on commercial paper, which regulators consider unsuitable due to its illiquidity during stress. The company began publishing quarterly attestations of its reserves with a third-party accounting firm that year, which serve as a time-limited snapshot into its holdings rather than a full audit.

In the coming year, Tether plans to publish data on its reserves in real time, Ardoino told Bloomberg News. Tether later said it had no hard-and-fast deadline to achieve this goal.

Future Goals and Tether’s Importance

Ardoino has articulated his objectives, including boosting technology investments, engaging in dialogues with regulatory authorities, and venturing into renewable energy. According to Riyad Carey, a research analyst associated with data firm Kaiko, Tether plays an immensely pivotal role within the industry, accounting for a significant proportion of the trading volume on centralised exchanges. The potential ramifications of a hypothetical shutdown of USDT are challenging to foresee, as it could significantly reshape the market landscape.

Incorporated in the British Virgin Islands, Tether has no public offices, no independent board, nor does it reveal much about its structure. It had around 60 employees overseeing USDT’s operation in May, Ardoino said in an interview at the time, a figure that he hoped would hit 90 by the end of 2023.

What’s discernible, however, is that Ardoino is inheriting a lucrative business. Most of the assets supporting the token are short-dated U.S. Treasury bills, according to a June attestation, netting the issuer a tidy profit while interest rates remain high. Tether reported around $3.3 billion in excess capital then, with Cantor Fitzgerald and Bahamian lenders Deltec Bank & Trust Ltd., Britannia Bank & Trust, and Capital Union Bank among its banking partners. Part of Ardoino’s new responsibilities will be managing the company’s finances, as well as directly supervising Tether’s research and development initiatives, he said.

Also Read: Earning Satoshis From Heat, Bitcoin Miners’ Brilliant Innovation

Balancing Roles

Ardoino will remain chief technology officer at Bitfinex, Tether’s sister crypto exchange, which shares much of its top brass with Tether. Jean-Louis van der Velde, Tether and Bitfinex’s current CEO, will transition into an advisory role at the stablecoin issuer once Ardoino takes over, the company said this month. Tether’s Chief Financial Officer Giancarlo Devasini also holds the same role at Bitfinex.

Related: Bitfinex Report Highlights Pros and Cons of BRC-20 Token Standard

A Passion for Bitcoin and Crypto Space

A staunch Bitcoin supporter, Ardoino jumped into crypto by joining Bitfinex as an engineer almost a decade ago after shutting down a fintech startup he founded in London. The role was focused on improving its matching engine, he said in an interview with Securities.io in May — and suited a growing Bitcoin passion he’d developed after reading the cryptocurrency’s initial whitepaper in 2012.

Ardonio told the Outlet, “I was experimenting and getting more and more excited about Bitcoin.” “The old, outdated protocols were no longer interesting, and I wanted to do something that was related to Bitcoin and the crypto space. I saw this as a huge opportunity to do something that would matter in the long run.” Bitfinex made him chief technology officer in 2015, and he took on the same role at Tether three years after the issuer joined forces with the crypto exchange.

Regulatory Challenges Ahead

Tether’s new leader is confronting significant challenges as regulatory pressure intensifies globally. In the European Union, strict regulations to be enforced from June 2024 will mandate stablecoin issuers to disclose corporate governance plans, shareholder information, and risk management practices. Simultaneously, expectations are mounting on Ardoino, Tether’s head, to fulfil a 2022 commitment to conduct a comprehensive financial audit of the company’s books, a critical milestone for the year ahead.

U.S. lawmakers and regulators have taken an extended period to enact sector-specific legislation concerning stablecoins. The delay has benefited Tether, according to Austin Campbell, who serves as an industry consultant and previously held the position of head of portfolio management at Paxos Inc., a stablecoin issuer.

Campbell emphasised that for Tether, the most unfavourable scenario would involve the imposition of standards and official recognition from the United States. Nevertheless, it is important to acknowledge that Tether may face increasing scrutiny and demands for compliance in the foreseeable future.

Also Read: G20 Finance Ministers and Central Bank Governors Embrace Roadmap for Crypto-Asset Regulation

Evaluating Paolo Ardoino’s Ascension

Paolo Ardoino, assuming the role of Chief Executive this December, marks a significant shift in the cryptocurrency landscape. Despite being a low-key figure, Ardoino will wield substantial influence, overseeing an $84 billion stablecoin and one of the crypto industry’s dominant enterprises. While the leadership of Tether has largely remained behind the scenes, Ardoino has emerged as its unofficial spokesperson. His new role promises to bring significant changes and challenges in a dynamic regulatory environment as the cryptocurrency industry evolves.

Author Profile

Latest entries

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style!

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style! NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S.

NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S. GAMING2024.03.17PS Plus: 7 New Games for March and Beyond

GAMING2024.03.17PS Plus: 7 New Games for March and Beyond GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It

GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It