In the dynamic landscape of technology and investment, one company is catching the eye of investors as it positions itself at the forefront of the Artificial Intelligence (AI) revolution. Micron Technology Inc., a prominent player in the semiconductor industry, is not only rebounding from the memory-chip downturn but is also carving a significant niche in the booming AI market.

Micron’s Fiscal Q1 2023 Triumph

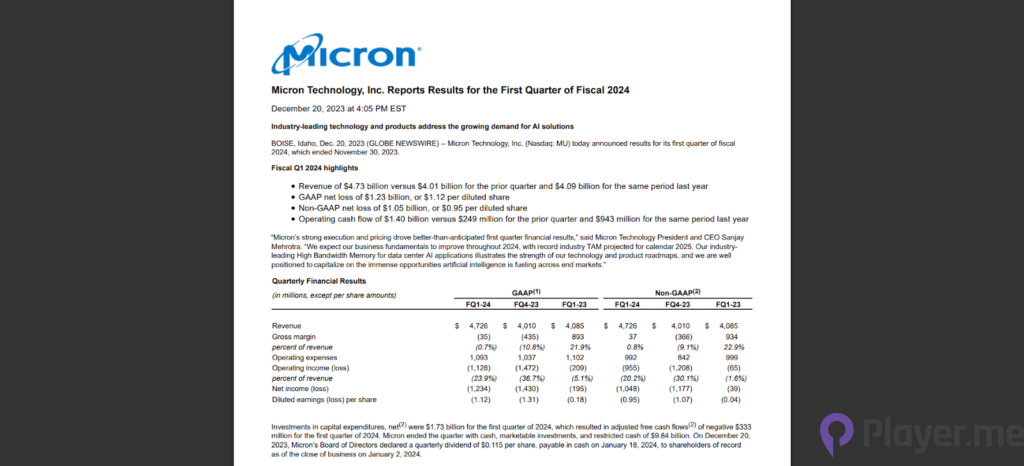

Micron’s recent fiscal first-quarter results have painted a promising picture of the company’s trajectory. Despite the challenges posed by the memory-chip downturn, the company reported a return to revenue growth, with Q1 revenue reaching $4.7 billion, a substantial 16% increase from the previous year. While a net loss of $1 billion was noted, the company projects a return to operating profit in the fiscal third quarter, signalling a robust recovery.

A significant driver behind their resurgence is the escalating demand for AI-related chips. As AI continues to permeate various industries, the need for advanced semiconductor solutions is skyrocketing. The strategic focus on catering to this demand is evident in its fiscal performance and signals a promising future for the company.

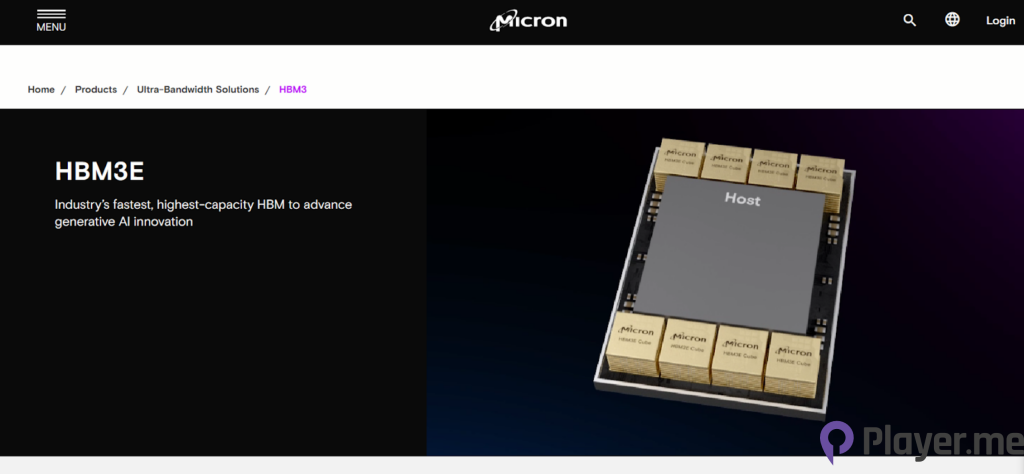

HBM3E Memory-Chip Module: A Game-Changer in AI

Micron’s foray into the AI landscape is further underscored by the introduction of its cutting-edge memory-chip module, HBM3E. Designed explicitly for AI and supercomputing applications, HBM3E is poised to play a pivotal role in shaping the future of AI technology. The company has announced that volume production of HBM3E is scheduled to commence in early calendar 2024, with expectations of generating several hundred million dollars in revenue for fiscal 2024.

One particularly noteworthy aspect is the overwhelming demand for HBM3E. Micron’s CEO, Sanjay Mehrotra, revealed that the HBM supply for calendar year 2024 is already sold out. This not only indicates the high demand for AI-centric memory solutions but also positions the company as a key player in meeting this demand.

Related: Exploring Boundless Potential: Top 5 Multimodal AI Tools Reshaping the Tech Landscape in 2024

Beyond Data Centres: Expanding AI Opportunities

While data centres traditionally have been a focal point for AI processing, Micron is strategically expanding its AI reach beyond these centralised facilities. The company recognises the immense potential for memory chips in AI-capable Personal Computers (PCs) and mobile devices. As AI applications increasingly operate locally on devices, they anticipate a surge in demand for memory solutions in the consumer electronics sector.

Micron forecasts growth in PC unit volumes by a low- to-mid-single-digit percentage in calendar year 2024, following two years of double-digit percentage declines. This growth is attributed to the anticipated production ramp-up of AI-capable PCs in the second half of 2024. According to Mehrotra, this will necessitate an additional capacity of four to eight gigabytes of Dynamic Random Access Memory (DRAM) per PC, along with increased solid-state drive capacities.

Smartphones: The Long-Term Frontier for AI

Looking ahead, Micron envisions a future where popular generative AI applications transition to smartphones. With the proliferation of AI capabilities in handheld devices, the demand for advanced memory and storage solutions is set to soar. They confidently assert that its leading product portfolio is well-positioned to seize these opportunities, aligning the company with the long-term growth trajectory of the AI market in the smartphone sector.

Financial Strategies: Balancing Growth and Discipline

Micron’s commitment to capitalising on AI opportunities is reflected not only in its product innovations but also in its financial strategies. The company is set to increase its capital spending in fiscal 2024, partly attributed to the manufacturing of the HBM3E modules. Despite this increase, the company executives emphasise maintaining discipline in capital expenditures, ensuring a strategic and sustainable approach to growth.

The company’s resilience and focus on financial discipline become even more apparent when considering external factors. Micron has not commented on a recent lawsuit filed against it by Chinese rival Yangtze Memory Technologies for patent infringement. Despite legal challenges and the complex landscape of international relations impacting the semiconductor industry, the roadmap to recovery appears robust and forward-focused.

Investor Sentiment and Future Outlook

Investors have taken notice of Micron’s strong performance and strategic positioning in the AI market. The company shares jumped 4% in after-hours trading following the release of its fiscal first-quarter results, indicating a positive response from the investment community. Analysts and investors alike are optimistic about their potential in the AI space, particularly with the impending growth in demand for AI-related chips.

Delano Saporu of New Street Advisors highlighted Micron’s potential in the AI landscape, stating,

“I think the big driver in 2024 for Micron is going to be AI. There’s going to be a lot more demand, and I think that’s why I’d be a buyer here”.

The CEO’s guidance for the current quarter, with revenue forecasted at $5.3 billion, further reinforces the confidence in Micron’s ability to capitalise on the burgeoning AI opportunities.

Micron’s stock has experienced a remarkable rise, up approximately 60% since the beginning of the year. While some tailwinds may be priced into the current valuation, analysts believe that there is still untapped potential for growth. As Micron continues to strengthen its fundamentals and position itself as a key player in the AI market, investors are increasingly viewing it as a thriving opportunity.

Read More: Featuring AI Chatbots: Top 5 Companies for Investment in 2023

Micron’s Journey in the AI Landscape

Micron Technology Inc. emerges as a thriving AI opportunity for investors, backed by its strong fiscal performance, innovative product offerings, and strategic positioning in the AI landscape. The introduction of the HBM3E memory-chip module and the anticipation of AI-driven growth in PCs and smartphones underscore Micron’s commitment to meeting the evolving demands of the technology landscape.

As AI becomes an integral part of various industries, the semiconductor companies driving its advancements are poised for significant growth. Micron’s journey from the memory-chip downturn to a resurgence marked by AI-related opportunities exemplifies the company’s adaptability and forward-thinking approach. For investors seeking exposure to the AI boom beyond conventional players, be sure to follow us by bookmarking our website so you don’t miss out on any important industry updates.

Author Profile

Latest entries

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style!

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style! NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S.

NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S. GAMING2024.03.17PS Plus: 7 New Games for March and Beyond

GAMING2024.03.17PS Plus: 7 New Games for March and Beyond GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It

GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It