In a recent development, the Venezuelan national oil-backed cryptocurrency, Petro (PTR), is set to cease operations on January 15th, marking the end of a tumultuous six-year journey. The coin, introduced in 2018 with the intention of circumventing U.S. sanctions, faced numerous challenges and controversies throughout its existence.

Read More: SEC Ends Crypto Drama by Giving the Green Light to 11 Bitcoin ETFs

Government Announcement Raises Questions

Reports of Petro’s impending shutdown surfaced, indicating an official announcement on the government-run website dedicated to the oil-backed cryptocurrency. However, accessing the website proved challenging at the time of writing, raising concerns about the transparency of the decision-making process.

Petro’s Troubled History

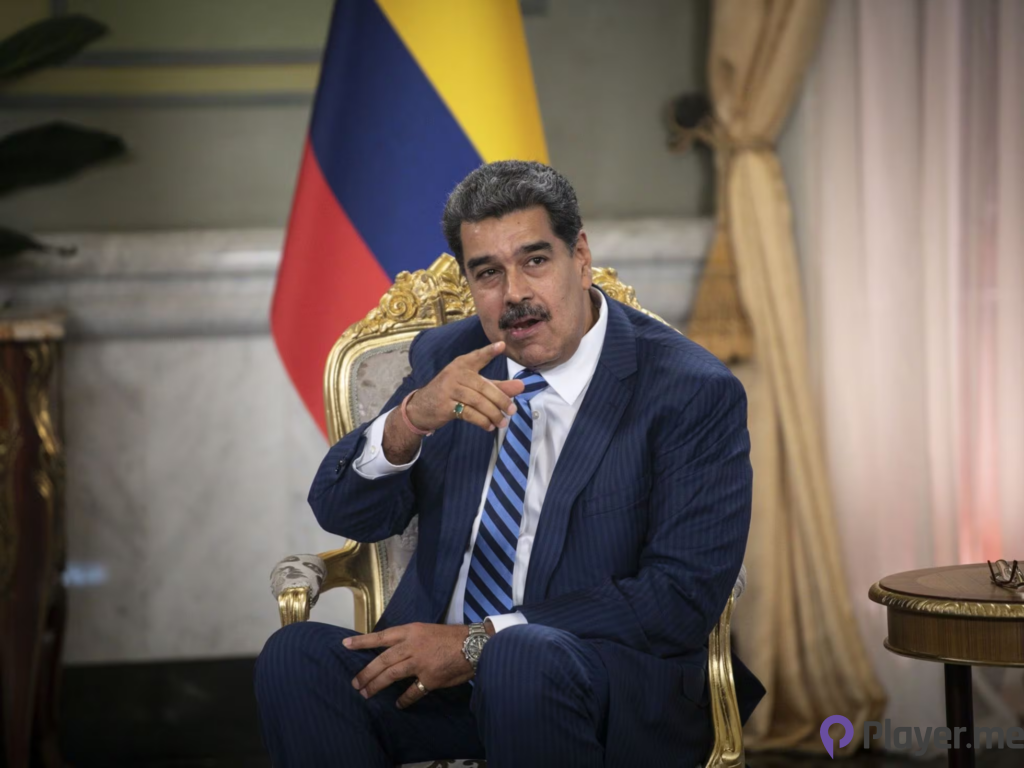

In a television address on December 3, 2017, Venezuelan President Nicolás Maduro introduced the Petro oil-backed cryptocurrency, revealing its backing from the nation’s reserves of oil, gasoline, gold, and diamonds. Maduro asserted that it would strengthen Venezuela’s “Monetary sovereignty” and provide access to “New forms of international financing.”. However, opposition leaders expressed scepticism, citing the country’s economic turmoil, including the devaluation of the Venezuelan Bolivar and a staggering $140 billion in foreign debt.

On January 5, 2018, Maduro disclosed plans to issue 100 million Petro tokens, valuing the entire issuance at just over $6 billion. Simultaneously, the government established VIBE, a cryptocurrency government advisory group led by Carlos Vargas, the “Superintendent of Cryptocurrencies”. The move prompted a response from Venezuela’s National Assembly, led by the opposition Democratic Unity Roundtable, which deemed it an illegal debt issuance, expressing a refusal to recognise its legitimacy.

A leaked document reviewed by Reuters shed light on VIBE’s recommendation for the government to conduct a private offering of $2.3 billion worth of Petros at a discount of up to 60%, casting doubt on Maduro’s valuation. The advisory group further proposed a public offering of $2.7 billion worth of Petros a month later, with the remaining allocation shared between the government and VIBE. The document also suggested accepting tax payments in Petros and allowing PDVSA, the state-owned oil company, to incorporate cryptocurrencies in its dealings with foreign entities.

Venezuela’s Crypto Mining Sector Grappled with Setbacks in March

In March 2023, state regulators in Venezuela issued an order to cease cryptocurrency mining operations. The directive followed an investigation into a corruption scheme where crypto wallets were implicated in redirecting payments owed to the state-run oil company, Petróleos de Venezuela. As a consequence, numerous miners faced the prospect of selling their rigs and permanently closing down operations.

During this challenging period, Maduro continued advocating for the use of cryptocurrencies, particularly the Petro sovereign token issued by the government. This push was positioned as a strategic tool to navigate economic sanctions and offer an alternative to the Venezuelan Bolivar.

Estimates from mining groups revealed that approximately 75,000 units of mining equipment were disconnected during this period. This volume is equivalent to an entire fleet owned by a major publicly traded mining company like Riot Platforms. The report further highlighted the active role of Venezuela’s intelligence police, Sebin, which audited miners.

Cryptocurrency Community’s Reaction Negatively to Petro

The introduction of the oil-backed cryptocurrency faced widespread scepticism within the crypto community. Economist Jean Paul Leidenz voiced concerns, emphasising the potential for it to exacerbate hyperinflation. Supply-side economist Steve Hanke, a specialist in Venezuelan hyperinflation, dismissed the petro as likely ending up “In the graveyard”. Hanke went on to describe it as a “Sham” and a “Fraud”, highlighting its non-existence in trading and its exclusion from the classification as a genuine cryptocurrency.

Analysts underscored Petro’s susceptibility to government control and centralization, identifying these factors as critical weaknesses. In contrast, financial journalist Max Keiser expressed support for oil-backed cryptocurrency, considering it a potential solution amidst the country’s hyperinflation crisis.

Bloomberg reported that various crypto-ranking organisations labelled the oil-backed cryptocurrency as a “Scam.” Websites such as ICOindex, ICObench, Cryptorated, and ICOreview either gave negative reviews or refrained from rating the Petro due to its questionable status. Initial criticism stemmed from Petro’s whitepaper, which lacked crucial information regarding its mechanism and technology. A subsequent version of the whitepaper addressed these gaps by introducing a different blockchain platform for its development.

Read More: Worldcoin’s Eyeball-Scanning Revolution Soars with Landmark Launch in Singapore

Scandals and Controversies Take a Toll

The oil-backed cryptocurrency’s journey was marred by scandals, notably the U.S. Immigration and Customs Enforcement issuing a $5 million bounty for the capture of Joselit Ramirez Camacho, the official overseeing Petro. Accused of ties to international narcotics trading, Camacho’s arrest in March 2023 led to the closure and reorganisation of the National Superintendency of Crypto Assets.

This subsequent closure extended through March 2024, contributing to the shutdown of various crypto exchanges and mining operations in the country. Despite initial plans for a Central Bank Digital Currency (CBDC) in 2021, Petro’s fate highlights the challenges of digital currency adoption within national economic frameworks.

The Future of Petro

The Venezuelan government’s attempts to integrate this oil-backed cryptocurrency into various services have met with challenges, as discussed above. While citizens were initially required to use the Petro to fund a social housing initiative, with the minimum wage tethered to it, it failed to garner widespread acceptance.

Recent reports indicate that any remaining tokens of the oil-backed cryptocurrency are now in the process of being converted to Bolivars, the nation’s struggling local currency. This move signifies a significant shift away from Petro, marking another setback for it. All of these events have collectively contributed to the challenges faced by Petro, once envisioned as an oil-backed cryptocurrency, a solution to circumvent economic sanctions and stabilise the nation’s financial position.

Author Profile

Latest entries

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style!

GAMING2024.06.12Top 4 Female Tekken 8 Fighters to Obliterate Your Opponents in Style! NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S.

NEWS2024.03.18Elon Musk’s SpaceX Ventures into National Security to Empower Spy Satellite Network for U.S. GAMING2024.03.17PS Plus: 7 New Games for March and Beyond

GAMING2024.03.17PS Plus: 7 New Games for March and Beyond GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It

GAMING2024.03.17Last Epoch Necromancer Builds: All You Need To Know About It